How to Set Up a Bitcoin Miner?

By this stage, you will understand how bitcoin works, and what mining means. But we need to get from theory to practice. How can you set up bitcoin mining hardware and start generating some digital cash? The first thing you need to do is decide on what hardware you’re going to use. There are two main things to think about when choosing it:

-

Hashrate: This is the number of calculations your hardware can perform every second as it tries to beat the target hash described in a previous section. Hashrates are measured in megahashes, gigahashes, terahashes, and exahashes per second (MH/sec, GH/sec, TH/sec, and EH/sec). The higher your hashrate (compared to the current average hashrate), the more likely you are to solve a transaction block. The Bitcoin wiki’s mining hardware comparison page is a good place to go for rough information on hashrates for different hardware.

-

Energy consumption: When choosing your hardware, it’s worth looking at the device’s energy consumption. Bitcoin mining rigs have a healthy appetite for electricity, and that costs money. You want to make sure you don’t end up spending all your money on electricity to mine coins that won’t be worth what you paid.

To work out how many hashes you’re getting for every watt of electricity that you use, divide the hash count by the number of watts shown in the technical specifications of the hardware.

For example, if you have a 500 GH/sec device, and it’s taking 400 watts of power, you’re getting 1.25 GH/sec per watt. You can check your power bill or use an electricity price calculator online to find out how much that means in hard cash.

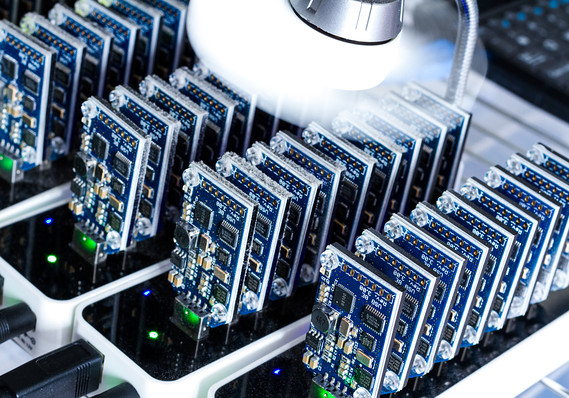

There are three main hardware categories for bitcoin miners: GPUs, FPGAs, and ASICs. We’ll explore them in depth below.

CPU/GPU bitcoin mining

The least powerful category of bitcoin mining hardware is your computer itself. Theoretically, you could use your computer’s CPU to mine for bitcoins, but in practice, this is so slow by today’s standards that there isn’t any point.

You can enhance your bitcoin hashrate by adding graphics hardware to your desktop computer. Graphics cards feature graphical processing units (GPUs). These are designed for heavy mathematical lifting so they can calculate all the complex polygons needed in high-end video games. This makes them particularly good at the Secure Hash Algorithm (SHA) - or SHA-256 in Bitcoin’s case - hashing mathematics necessary to solve transaction blocks.

One of the nice things about GPUs is they also leave your options open. Unlike other options discussed later, these units can be used with cryptocurrencies other than bitcoin. Litecoin, for example, uses a different proof-of-work algorithm to Bitcoin, called Scrypt. This has been optimized to be friendly to CPUs and GPUs, making them a good option for GPU miners who want to switch between different currencies. However, similar to bitcoin mining, ASICs now dominate the litecoin mining landscape.

CPU and GPU mining are no longer viable these days. Bitcoin’s mining difficulty has accelerated so much with the release of ASIC mining power that simple graphics cards can’t compete.

FPGA miners

A Field Programmable Gate Array (FPGA) is an integrated circuit designed to be configured after being built. This enables a mining hardware manufacturer to buy the chips in volume, and then customize them for bitcoin mining before putting them into their own equipment. Because they are customized for mining, they offer performance improvements over CPUs and GPUs. Single-chip FPGAs have been seen operating at around 750 MH/sec, although that’s at the high end, although manufacturers could put more than one chip on a board.

They were a significant upgrade over CPU and GPU mining at the time. However, today FPGAs are no longer competitive in bitcoin mining due to their low performance.

ASIC chips

This is where the action is. Application Specific Integrated Circuits (ASICs) are specifically designed to do just one thing: mine bitcoin at mind-crushing speeds as efficiently as possible. Because these chips have to be designed specifically for that task and then fabricated, they are expensive and time-consuming to produce – but the speeds are stunning. At the time of writing, units are selling with speeds anywhere from 7-14 Terahash/second (1 Terahash = 1 trillion hashes.) It will be interesting to see if there is more progress to be made past the 14 TH/sec point.

Before making your purchase, calculate the projected profitability of your miner, using mining profitability calculators online like this one. You can input parameters such as equipment cost, hashrate, power consumption and the current bitcoin price to see how long it will take to pay back your investment.

One of the other key parameters here is network difficulty. This metric determines how hard it is to discover new blocks, and varies according to the network hashrate. The difficulty is likely to increase substantially as ASIC devices come on the market, so it might be worth increasing this metric in the calculator to see what your return on investment will be like as more people join the game.

You may well need mining software for your ASIC miner, too, although some newer models promise to ship with everything pre-configured, including a bitcoin address so that all you need to do is plug it in the wall.

Now, you’re all set up. Good for you. But chances are you won’t stand much chance of successfully mining bitcoin unless you work with other people, by joining a bitcoin mining pool for example. Nowadays, the bitcoin mining industry primarily operates on a pool level rather than on an individual level. Some of the biggest bitcoin mining pools in the world right now are F2Pool, Poolin, Binance Pool and AntPool.