How To Draw Perfect Support And Resistance In The Forex Market?

Supporting and resistance zones are crucial elements in predicting the range at which the exchange rate of a currency will likely turn.

It's what I've done practically from the beginning of my trading career.

The issue is that these areas may be very subjective. In many instances, only certain supports or resistance may be approximated by a trader.

I recall it was difficult to find the right areas on my graph. I would also be disheartened if I observed other more experienced Forex traders on their chart identifying better or other ranges.

Then I started to investigate "how to attract support and resistance." I found a few blogs and even purchased a trading Forex course on the subject.

I honestly feel that the publicly accessible guidance is highly subjective in defining the appropriate areas. It's not leading anyplace.

I initially heard about drawing the appropriate zones via a line graph. It benefited a little.

I still find it somewhat challenging to apply this method. It is difficult to differentiate between the robust and the feeble support regions.

Gradually, I came up with another method of identifying the areas. I noticed that this new method has greatly minimized confusion. As an additional benefit, it also provides an overview of the behavior of the market.

One of the top UK forex traders can help you keep your portfolio in the marketplace.

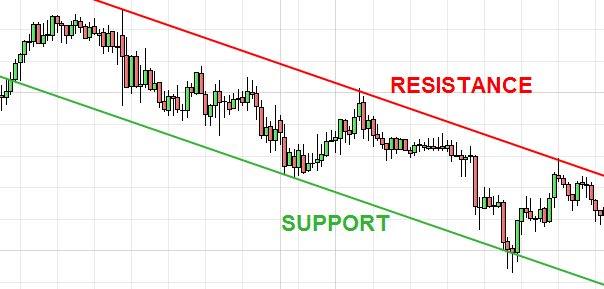

Great Way to Draw Support and Resistance

The underlying narrative provided allows me to explain the method I follow to create support and resistance regions vividly.

Select the Favourable Chart Type

This initial stage is really easy and complex. You only have to browse any chart to choose the kind you want. I use candlesticks, but whichever you desire is up to you.

Just do it! I urge you to implement, reading is dull!

Recognize the Swing Highs and Lows

The margins don't have to be completely low. What is essential here is to create a basic line at all heights and lower levels. It ought not to be too subjective.

The strong feature of this stage is that you can quickly tell irrespective or not the marketplace is in a trend, because you observe the ups and downs.

Read the full forex reviews to get the right broker out of the lot.

Connect Limbs of Highs and Lows

The final stage in creating support zones comprises connecting the highs and lows with horizontal lines. These are your major areas of support and opposition.

The lines you construct are nearly non-exactly on the highs and lows you have defined. That's quite natural, be all well with it. Anytime you believe that 2 highs/lows may be connected, draw a horizontal line.

After this procedure has been finished, you may be sure that the lines indicate unambiguous support and resistance areas. You can change your lines constantly, but it shouldn't be required.

Compare the Lines

The lines created appear identical in both instances. The line chart now includes one additional line, as you can see. For my part, I like to keep matters straightforward. I just search for the major resistance and support sectors.

Conclusion

It is essential to realize that in each time period this technique works well. The reasoning is the same.

Assure that the areas you specify link up to or down to 2+. The more, the better.

You might argue that this procedure produces the same result as the identification of support and resistance zones using a line chart.

I concur. However, I believe that this method is easier and aids to detect the pattern.

Finally, make sure you're familiar with the method you employ to determine the support and areas on your chart!

Choose from the top 10 forex brokers in the world to get support and resistance in the forex market.