Can cryptocurrencies be included in the portfolio of a sensible investor?

“Should I buy Bitcoin?”

“What do you think of cryptocurrencies?”

Even if the party is merely a virtual one on Zoom, these are now popular queries on the party circuit.

The question is whether cryptocurrencies should be included in the portfolio of a prudent investor. And here's my attempt to provide a systematic response.

But first, some background on cryptocurrency: how it began, what its history has been, and the most essential topic that many people are unsure about: what exactly is a cryptocurrency?

While we're on the subject of cryptocurrencies in general, much of the background information focuses on Bitcoin, simply because it's the one digital token that's been around the longest and has a history, if you will!

-

First off, what is Bitcoin?

Of course, it's a digital asset. It was started utilising blockchain technology, which makes it unique. Later, other cryptocurrencies such as Ether (Ethereum), Tether, Binance Coin, Dogecoin, and others used the similar technology.

What is blockchain technology, exactly? Most common databases, such as SQL, have a supervisor. As a result, the ‘in charge' entity has the ability to alter the entries — even adding extra cash, for example.

Blockchain is unique in that no one is in charge. A blockchain is essentially a digital ledger of transactions that is replicated and distributed across the blockchain's entire network of computer systems. Because every user system has a copy of the ledger, it is difficult, if not impossible, to change, hack, or cheat the system. As more people log in, the system becomes more secure.

This is why Bitcoin (BTC) has succeeded where many other forms of digital money schemes have failed in the past. It resolved the issue of trust. Bitcoins cannot be faked, hacked, or double-spent, so those who own them can be confident that they are valuable.

There are a total of 21 million Bitcoins available for mining. 18.7 million of these have already been mined.

-

How have Bitcoin prices moved in the past?

Now, what is the history of Bitcoin's value or price? To put it mildly, it has seen some wild gyrations!

The first Bitcoin was mined in 2009, and the initial ‘value' was 0.076 cents. Yes, you read that correctly! Back then, a dollar could buy over 1,300 bitcoins.

Laszlo, a developer and early adopter, offered 10,000 BTC for two large pizzas on bitcointalk.org in May 2010. Someone took him up on his offer and placed an order for two pizzas. These pizzas, which cost around $25, established the first ‘real-life' value for BTC at $0.0025. This was a significant milestone in Bitcoin's history, and it is now known as "Bitcoin Pizza Day" in the Bitcoin ecosystem.

In 2011, Bitcoin surged to $1, then $10, then nearly $32, before plummeting to $10 in just four days. It wouldn't be the last time Bitcoin prices followed a parabolic trend.

In April 2013, the price of Bitcoin topped $100 for the first time, while the market capitalization had just crossed the $1 billion mark a few days before. After another exchange attack, Bitcoin climbed to $266 before plummeting to approximately $100. In November of that year, it surpassed the $1,000 mark. But, in a matter of months, a ban from China and the bankruptcy of Mt Gox drove the price back down, and Bitcoin wouldn't cross that psychological barrier again until January 2017.

The year 2017 has been a highly intriguing one for Bitcoin and the ecosystem as a whole. By December 2017, the cryptocurrency has risen from roughly $1,000 to around $19,000.

Bitcoin, which had plummeted more than 50% to $4,800 at the height of the Covid-19 crisis, was no exception to the 'rush for cash' by March 2020. The rebound, however, was equally ferocious, with the BTC reaching an all-time high of $64,000 on April 14, 2021. Coincidentally, the current high was hit on the same day that Coinbase (COIN) was listed on Nasdaq at an eye-popping valuation of $100 billion. Bitcoin has, of course, seen another crash since then.

-

Bitcoin vs Gold: Right match?

Bitcoin is frequently referred to as "digital gold" or a "store of wealth." Remember that gold survived the termination of gold coinage, the development of paper money, the collapse of the gold standard, and so on to become what it is now and be in all these bank vaults throughout the world. It overcame numerous obstacles to become what it is today.

-

Is the volatility in a new asset class natural?

It's only logical that this unique asset class/payment method will experience volatility. The concept of antifragility may apply here, implying that the longer something endures, the more reputable it gets. And it makes perfect sense as a liquid, transportable store of value for the new generation. After all, the value of gold or diamonds is intrinsically determined by the buyer's willingness to pay.

Bitcoin, according to one perspective, is to millennials what gold was to us a generation ago. It's liquid, mobile, inflation-hedging, and growth-oriented. All of the characteristics that we grew up identifying with gold are now associated with Bitcoin.

The investor's notion of what is "safe" determines the level of risk. Consider two easy methods for determining this: price volatility and maximum drawdown (the maximum decline from the peak point to a pullback low).

Bitcoin is five times more volatile than gold and ten times more volatile than the US Dollar in terms of volatility (DXY). Meanwhile, BTC has had a maximum drawdown of 83 percent, compared to 20 percent for gold and 14 percent for the US currency. Another piece of empirical evidence of BTC's infamous risk profile can be found in the largest one-day loss recorded: 27 percent! (March 12, 2020).

-

It doesn’t look like a store of value; does it?

A complete loss of principal is also a possibility. You are assuming counter-party risk by storing your Bitcoins in an exchange wallet (also known as a "hot wallet" or "online wallet") (hack, default, etc). A 'cold wallet' can be useful in this situation. A ‘cold wallet' is one that is not connected to the Internet and hence has a far reduced risk of being hacked.

Now, let's get to the main question we set out to answer:

Should a prudent investor include Bitcoin/cryptocurrency in their portfolio?

Does this volatility mean that crypto should not be a part of your investment portfolio? Not quite.

The thing is, rather than evaluating it solely on its own merits, it is critical to consider any investment as part of a portfolio to determine whether it adds any value to your original portfolio in terms of risk-adjusted return.

BTC performs far better than expected in this regard.

The real question to be addressed is: Should you ever add a volatile asset to your portfolio?

If the asset's returns are uncorrelated/negatively correlated with the rest of your holdings, the answer may be yes. In this situation, a little sliver of a volatile asset could help your portfolio perform better.

Bitcoin's empirically low connection with other asset classes necessitates a review of its possible position in an investing portfolio. For our analysis, we utilised Bitcoins because it is the only crypto asset with a long enough history to be useful.

Let’s consider a simple but well-diversified base portfolio comprised of 60% global equities, 30% global bonds, 5% commodities, and 5% global REITs. We will contrast this portfolio with variants in which 1%, 2%, and finally 3% of capital is allocated to Bitcoin.

Let’s look at the results:

-

Even a 1% allocation to Bitcoin (BTC) resulted in an annual outperformance of 1.2 percent over the Base Portfolio, with almost no additional volatility.

- The risk-adjusted return (CAGR/Volatility) for the 1% BTC portfolio increased to 0.86, compared to 0.73 for the Base Portfolio.

There is, thus, a case to be made for adding a small sliver of cryptocurrency in a diversified portfolio.

-

Can crypto be used as currency for transactions?

Can there be a future world operating on digital currencies?

One of the fundamental functions of a currency, as we learned in Economics 101, is to serve as a medium of exchange. Two things are required for this to happen: One, the currency's value should be relatively steady over time. Two, the infrastructure that surrounds it should be capable of processing large transactions fast.

For starters, due to its huge price swings, the value of digital money is inherently unpredictable, making it a poor choice for determining the value of other commodities and services.

Bitcoin can't even come close to competing with legacy payment systems in terms of transaction speed. It's far behind Visa's maximum capacity of 65,000 transactions per second and near-instant payments, with a capacity of just seven transactions per second and an average confirmation time of ten minutes.

Furthermore, because there are only so many transactions that can fit in a block when the network is overloaded, fees can spike as users compete for a spot in the next block. However, certain modifications are on the way that could eliminate all of these issues, such as a ‘Lightning Network.'

-

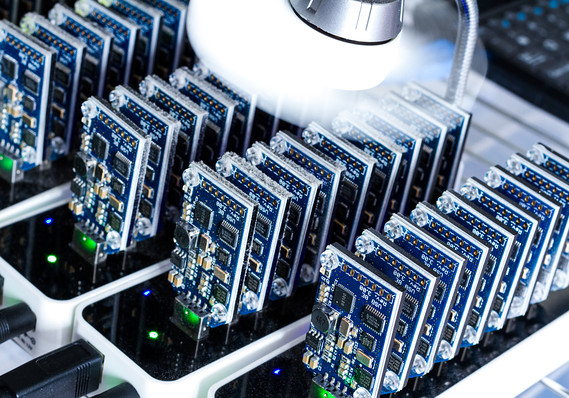

Elephant in the room: The Ecological cost

A ‘proof-of-work' system would be used to confirm cryptocurrency transactions. Miners are required to solve computationally expensive and complex cryptographic challenges as part of this method. For their efforts, miners get compensated in the form of digital currency. This workout, however, necessitates a large amount of energy expenditure.

Bitcoin currently consumes 0.62 percent of the world's total electricity, putting it in the 27th place in yearly electricity usage if it were a country! The environmental impact of Bitcoins is real and significant, even though Elon Musk appears to have only recently become aware of it!

According to a recent analysis from Cambridge University, renewable energy, particularly hydroelectric electricity, powers about 39% of proof-of-work mining. China is the most powerful player in this market. However, a significant amount of commercial energy is still consumed.

-

Transaction costs, aka the ‘Coinbase’ Loot

If a Bitcoin transaction exceeds $100, Coinbase, the much-heralded startup that recently went public, imposes a staggering 1.49 percent variable fee. For example, if you buy $1,000 worth of Bitcoin with your bank account, you'll end up with $985 worth of the digital currency. They also impose a 0.50 percent markup above the real price on bitcoin transfers (some users claim it may reach as high as 3 percent). Of instance, the transaction fee on one of the most liquid exchanges, Binance, is only 0.10 percent.

In terms of transaction costs, there is still a lot of inefficiency. However, this is not an insurmountable barrier, and we anticipate that, like with many other new technologies, like as solar power and electric vehicles, it will eventually align to more reasonable levels.

Aside from buying the currencies directly, liquid exchange-traded funds (ETFs) are available for investors interested in the emerging crypto economy's possibilities. These funds invest in firms throughout the world that are either actively using, investing in, creating, or producing blockchain-related products.

These exchange-traded funds (ETFs) offer a less volatile way to invest in the cryptocurrency market. Amplify Transformational Data Sharing ETF (BLOK), Bitwise Crypto Industry Innovators ETF (BITQ), Siren ETF Trust Siren Nasdaq NexGen Economy ETF (BLCN), First Trust Index Innovative Transaction & Process ETF (LEGR), and VanEck Vectors Digital Transformation ETF are some of the well-known and newly launched ETFs in this space (DAPP).