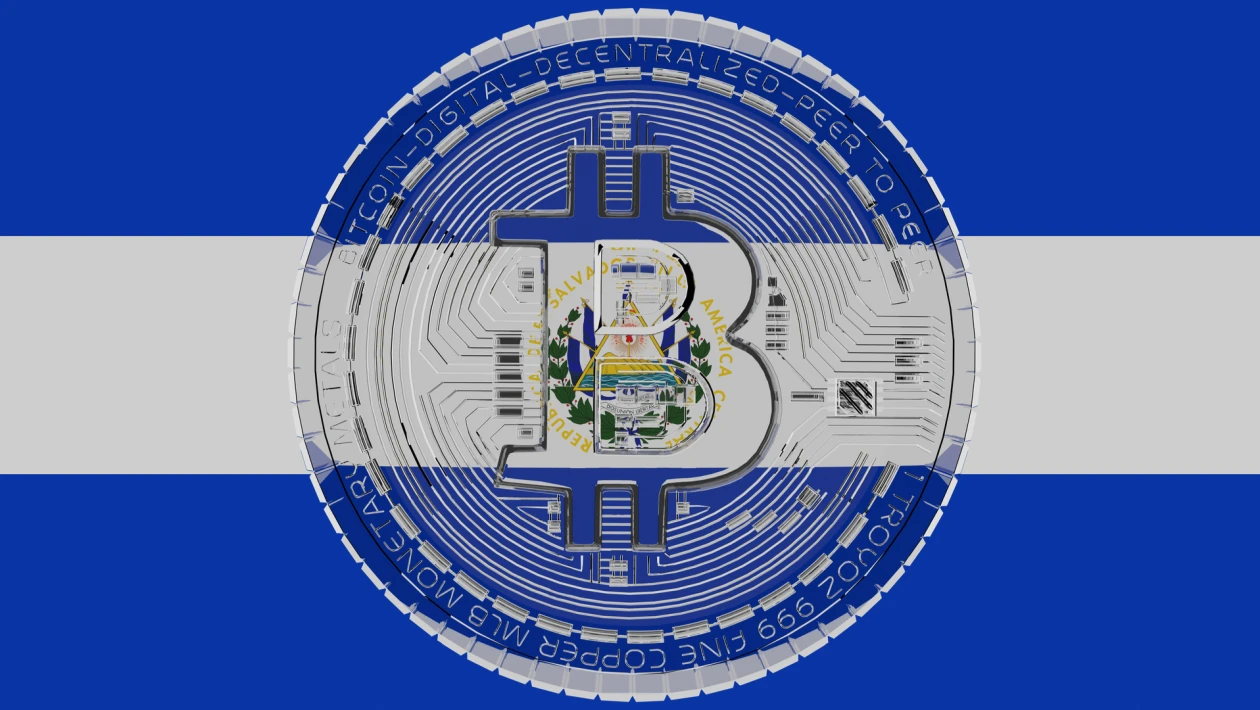

After a 35% drop in May, Bitcoin is still being called as a bubble.

Even after last month's 35% drop, the belief that Bitcoin is a symbol of speculative excess and froth remains strong.

In a study conducted by Bank of America Corp., about 80% of fund managers considered the market a bubble, up from 75% in May. According to the poll, “long Bitcoin” is the second-most crowded trade after commodities, with 207 participants representing $645 billion in assets.

The results suggest that some professional managers are sceptical of crypto as a viable asset class because of its tremendous volatility and regulatory unpredictability. Cryptocurrency bubble fears are nothing new, and many investors have expressed reservations about investing in an asset with no fundamental underpinnings.

Despite the fact that prices have fallen, investment banks continue to support the emerging asset class.

Goldman Sachs Group Inc. aims to offer clients Ethereum derivatives, and Cowen Inc. plans to provide “institutional-grade” cryptocurrency custody services.

This week, legendary hedge fund manager Paul Tudor Jones boosted prices by reiterating his belief that Bitcoin is an excellent inflation hedge.

In an interview with CNBC, Tudor Jones of Tudor Investment Corp. said, "I prefer Bitcoin as a portfolio diversifier." “Everyone wants to know what I should do with my Bitcoin. The only thing I know for sure is that I want 5% of my portfolio in gold, 5% in Bitcoin, 5% in cash, and 5% in commodities.”